Al Rajhi Bank, one of the world’s largest Islamic banks by capital, plays a crucial role in Saudi Arabia’s financial landscape. Headquartered in Riyadh, the bank is renowned for its commitment to Sharia-compliant banking, innovative digital services, and expansion of its customer base. Its steady growth, supported by strong asset quality and profitability, highlights Al Rajhi’s stability going into 2026. in Saudi Arabia’s banking sector.

With NAGA, you can buy Al Rajhi shares to benefit from consistent dividends and capital appreciation, trade Al Rajhi CFDs through KSA ETF for leveraged short-term trading, or invest in ETFs featuring Al Rajhi stock.

Why Invest in Al Rajhi Bank Stock – Key Takeaways

- Attractive valuation: Trades competitively relative to peer banks with solid fundamentals.

- Dividend income: Offers a dividend yield of approximately 2.86%, appealing for income investors.

- Financial health: Strong earnings growth, asset quality, and capital adequacy ratios.

- Investment flexibility: Own shares for dividends and voting, or trade CFDs via iShares MSCI Saudi Arabia ETF (KSA) for agile market strategies.

Alternatively, you can copy the moves of top performing traders in real-time with NAGA Autocopy.

Overview of Al Rajhi Bank Stock

Founded in 1957, Al Rajhi Bank is one of the largest Islamic banks globally and a key player in Saudi Arabia's financial sector. The bank excels in providing Sharia-compliant banking services, continuously expanding its digital banking capabilities and customer base. Al Rajhi Bank plays a pivotal role in supporting Saudi Arabia's Vision 2030 by promoting financial inclusion and economic diversification.

Al Rajhi Bank is included in major indices such as the MSCI Emerging Markets Index and the MSCI Saudi Arabia IMI Islamic Index. It is also part of key Saudi stock market benchmarks like the Tadawul All Share Index (TASI). These inclusions highlight AlRajhi’s prominence and importance in Saudi Arabia’s capital markets and its exposure to regional and global investors.

- Ticker: 1120 (Tadawul)

- Sector: Banking & Financial Services

- Public float: Approx. 33.0%

- Employees: 23,420+

Its strong market position, extensive branch network, and focus on innovation solidify Al Rajhi’s reputation as a cornerstone institution in the Saudi financial landscape, making it an attractive choice for investors looking for the best Saudi stocks to buy in 2026 and beyond.

Al Rajhi Bank Stock Analysis and Forecasting

Al Rajhi stock is held by institutional and individual investors, as well as sovereign wealth funds, for several reasons:

Attractive valuation

The stock is valued favorably with price-to-earnings and price-to-book ratios supportive of a strong investment case.

Growth potential

Al Rajhi continues to expand its lending and deposit base, supported by innovations in digital banking and expanding Saudi market penetration.

Dividend payout

A consistent dividends yield near 2.86% accompanies steady earnings, providing reliable income.

Strong financial position

Robust capital buffers, controlled credit risks, and profitable operations contribute to durable financial health.

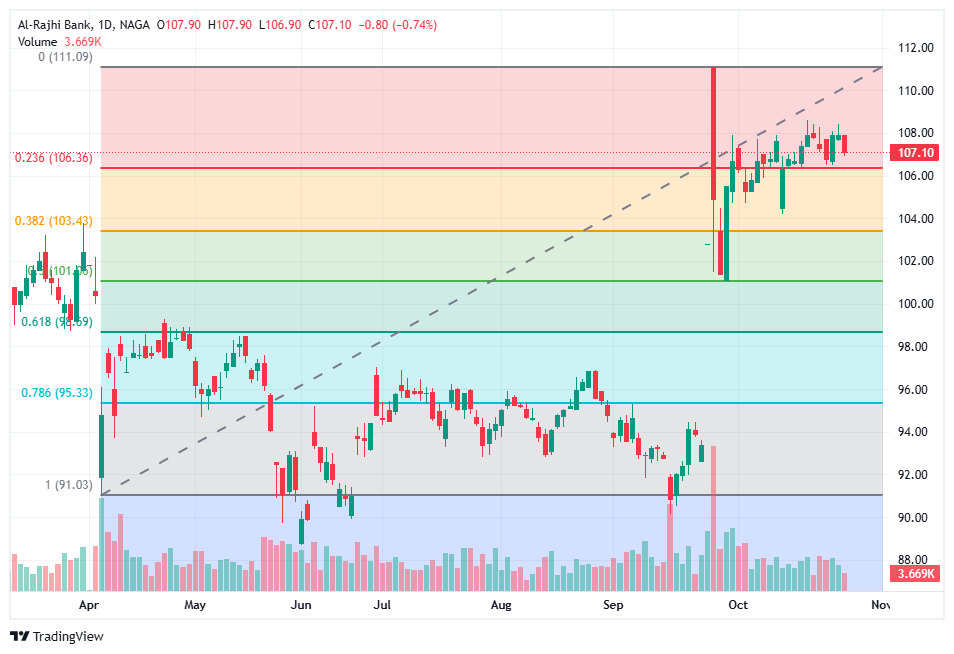

Bullish Al Rajhi stock chart pattern

Recent technical analysis shows the stock near resistance at 108 SAR; a breakout could lead to targets around 112-115 SAR.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Technical traders using the NAGA WebApp can leverage real-time charts, indicators, and automated alerts to time entries and exits.

Bullish Al Rajhi stock price forecast

Analyst estimates set a 12-month average price target near 112 SAR, with high projections up to 121.40 SAR and lows around 91 SAR. The outlook reflects confidence in the bank’s performance with cautious regard to macroeconomic influences and sector risks.

Important: When considering AlRajhi's fundamental analysis, financial rating and price predictions, it’s important to remember that high market volatility and a changing economic environment make long-term estimates difficult. As such, analysts and algorithm-based platforms can and do get their ratings and predictions wrong. Always do your own research before making an investment decision. And never trade or invest more than you can afford to lose.

How to invest in Al Rajhi stock?

Investing or trading Al Rajhi stock offers multiple approaches to align with investment goals and risk preferences.

Buy shares of Al Rajhi stock

On NAGA, you can open an Invest account to directly purchase Al Rajhi shares listed on Tadawul. Owning shares grants dividend rights and voting privileges, ideal for long-term investors focused on compounding wealth through stock appreciation and income.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Trade Al Rajhi shares CFD via KSA ETF

If you prefer active trading or want to profit from both rising and falling prices, NAGA’s Trading account enables you to trade Al Rajhi CFDs with leverage. CFDs allow you to open long or short positions with lower capital outlay, daily margin requirements, and fast order execution.

ETFs holding Al Rajhi stock

Another way to gain exposure to Al Rajhi stock is through ETFs that include Al Rajhi in their portfolios. Funds like iShares MSCI Saudi Arabia ETF (KSA) offer diversified access to major Saudi companies and the broader petrochemical sector, enabling risk spreading and simplified investing. Other ETF with Al Rajhi stock among its holdings are iShares MSCI EM and JP Morgan EM (JMG), all available on NAGA platforms.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

How to get started with Al Rajhi stock on NAGA

Here is how to buy and trade Al Rajhi stock with NAGA, a trademark of The NAGA Group AG, a German-based FinTech company publicly listed on the Frankfurt Stock Exchange:

- Select account type – Choose between an Invest account for full ownership or Trading account for CFD trading.

- Register & verify – Complete registration and KYC verification for compliance.

- Deposit funds – Add Saudi Riyals, USD, or other supported currencies.

- Search “AL RAJHI” or Ticker “1120” – Access Al Rajhi shares or or CFDs via exposure to the “KSA” ETF on the platform.

- Buy or trade – Place orders to buy shares or open CFD positions with customizable leverage.

- Manage your portfolio – Use NAGA’s portfolio tracking, social trading, and risk management tools.

Buy Al Rajhi stock Trade Al Rajhi stock via KSA ETF Copy lead traders

Should you buy Al Rajhi stock today?

Al Rajhi is focus on disciplined growth, operational excellence, and new high-margin projects like green hydrogen and advanced chemical technologies. If you seek long-term exposure to Saudi Arabia’s industrial diversification and sustainable materials innovation, Al Rajhi could be a worthy addition to your portfolio. Consider your investment horizon and risk tolerance, as market fluctuations and sector cyclicality persist.

Whether you choose direct ownership, CFD trading via CFDs through the iShares MSCI Saudi ETF, or ETFs holding Al Rajhi stock, each option provides unique benefits to capture Al Rajhi’s potential in your portfolio strategy.

Learn more about leading Saudi stocks

Free resources

Before you start investing in Al Rajhi stock, you should consider using the educational resources we offer like NAGA Academy or a demo trading account. NAGA Academy has lots of free trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a more informed trader.

Our demo account is a great place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading.

Sources:

- About alrajhi bank | Alrajhi Bank

- Al Rajhi Banking and Investment Corporation (1120.SR) Stock Price, News, Quote & History - Yahoo Finance

- Al Rajhi Bank Stock Forecast: 1120 Stock Price Prediction, Long-Term; Short-Term Share Revenue - Walletinvestor.

- Al Rajhi Banking and Investment Corporation (SASE:1120) Stock Valuation - Simply Wall St