Saudi Telecom Company (STC) is the dominant telecommunications provider in Saudi Arabia, holding over 50% market share. Established as a regional leader, STC is rapidly expanding across the Gulf, Middle East, and Africa while investing heavily in 5G technology and enhancing digital service offerings. These strengths position STC well for sustained growth and innovation leadership in 2026 and beyond.

With NAGA, investors can buy STC shares to benefit from dividends and capital appreciation, trade STC CFDs through KSA ETF for short-term leveraged trades, or invest in ETFs including STC stock.

Why Invest in STC Stock – Key Takeaways

- Attractive valuation: Trades at a reasonable price-to-earnings ratio of 18.85x, reflecting balanced valuation.

- Dividend income: Provides a stable dividend yield near 5.5%, attracting income-focused investors.

- Financial health: Net profit rose 13.38% in H1 2025, reaching SAR 7.47 billion, highlighting operational strength.

- Growth initiatives: Strong investments in 5G infrastructure and regional expansion support future earnings potential.

- Investment flexibility: Own shares for dividends and voting rights or trade CFDs via iShares MSCI Saudi Arabia ETF (KSA) with NAGA for agile exposure.

Alternatively, you can copy the moves of top performing traders in real-time with NAGA Autocopy.

Overview of Saudi Telecom Company (STC) Stock

Saudi Telecom Company (STC), established in 1998 and headquartered in Riyadh, is the leading telecommunications provider in Saudi Arabia and a key player in the Middle East region. The company holds over 50% of the Saudi telecom market, offering a wide range of services including mobile, fixed-line, internet, and digital solutions. STC is heavily investing in next-generation technologies like 5G and expanding its footprint regionally across the Gulf Cooperation Council (GCC), Middle East, and Africa. These initiatives align closely with Saudi Arabia’s Vision 2030 goals, positioning STC for sustainable growth and innovation leadership.

STC is included in major indices such as the MSCI Emerging Markets Index and the MSCI Saudi Arabia IMI Islamic Index. It is also part of key Saudi stock market benchmarks like the Tadawul All Share Index (TASI). These inclusions highlight STC’s prominence and importance in Saudi Arabia’s capital markets and its exposure to regional and global investors.

- Ticker: 7010 (Tadawul)

- Sector: Telecommunications

- Public float: Approx. 33.5%

- Employees: 18,000+

With its strong global presence, diversified portfolio, and alignment with Saudi Arabia’s Vision 2030, STC remains one of the best Saudi stocks to buy in 2026.

STC Stock Analysis and Forecasting

STC stock is held by institutional and individual investors, as well as sovereign wealth funds, for several reasons:

Attractive valuation

P/E ratio of 18.85 and solid earnings growth support the investment case.

Growth potential

H1 2025 revenues increased by 2.09% to SAR 38.66 billion, underpinning a 13.38% net profit growth.

Dividend payout

A reliable 5.5% dividends yield reflects strong cash flow and shareholder value focus.

Strong financials

Robust profitability and efficient capital management contribute to business stability.

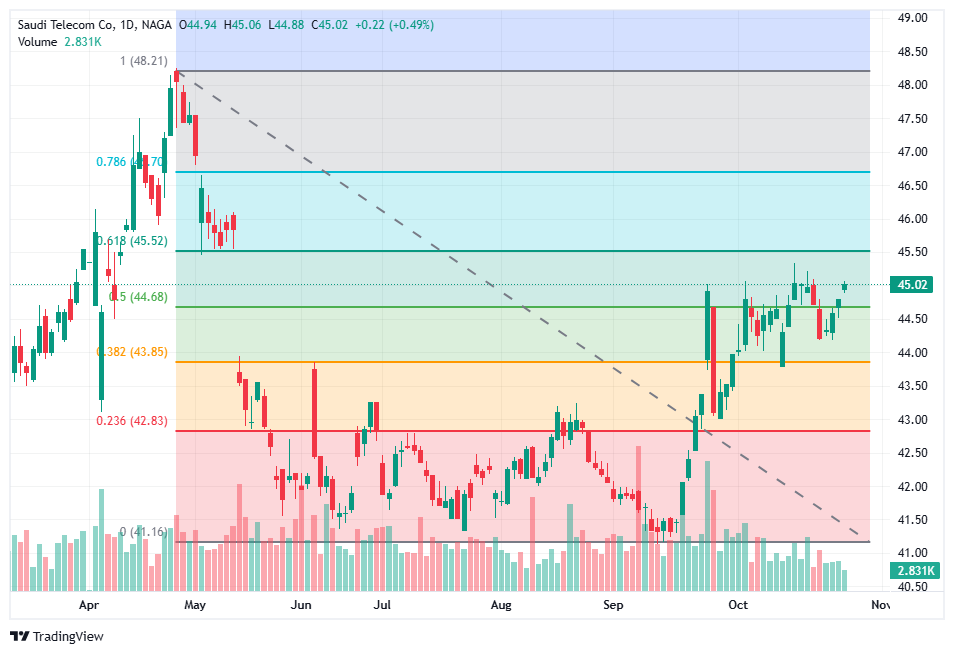

Bullish STC stock chart pattern

Recent price consolidations have approached resistance near 45 SAR, with potential upward targets at 48-50 SAR.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Technical traders using the NAGA WebApp can leverage real-time charts, indicators, and automated alerts to time entries and exits.

Bullish STC stock price forecast

Analysts estimate a 12-month average price target of 48.5 SAR, with a high target near 53 SAR and a low of approximately 42 SAR. Growth prospects balanced by competitive pressures underpin this outlook.

Important: When considering STC's fundamental analysis, financial rating and price predictions, it’s important to remember that high market volatility and a changing economic environment make long-term estimates difficult. As such, analysts and algorithm-based platforms can and do get their ratings and predictions wrong. Always do your own research before making an investment decision. And never trade or invest more than you can afford to lose.

How to invest in STC stock?

Investing or trading STC stock offers multiple approaches to align with investment goals and risk preferences.

Buy shares of STC stock

On NAGA, you can open an Invest account to directly purchase STC shares listed on Tadawul. Owning shares grants dividend rights and voting privileges, ideal for long-term investors focused on compounding wealth through stock appreciation and income.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Trade STC shares CFD via KSA ETF

If you prefer active trading or want to profit from both rising and falling prices, NAGA’s Trading account enables you to trade STC CFDs with leverage. CFDs allow you to open long or short positions with lower capital outlay, daily margin requirements, and fast order execution.

ETFs holding STC stock

Another way to gain exposure to STC stock is through ETFs that include STC in their portfolios. Funds like iShares MSCI Saudi Arabia ETF (KSA) offer diversified access to major Saudi companies and the broader petrochemical sector, enabling risk spreading and simplified investing. Other ETF with STC stock among its holdings are iShares MSCI EM and JP Morgan EM (JMG), all available on NAGA platforms.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

How to get started with STC stock on NAGA

Here is how to buy and trade STC stock with NAGA, a trademark of The NAGA Group AG, a German-based FinTech company publicly listed on the Frankfurt Stock Exchange:

- Select account type – Choose between an Invest account for full ownership or Trading account for CFD trading.

- Register & verify – Complete registration and KYC verification for compliance.

- Deposit funds – Add Saudi Riyals, USD, or other supported currencies.

- Search “Saudi Telecom Co” or Ticker “7010” – Access STC shares or or CFDs via exposure to the “KSA” ETF on the platform.

- Buy or trade – Place orders to buy shares or open CFD positions with customizable leverage.

- Manage your portfolio – Use NAGA’s portfolio tracking, social trading, and risk management tools.

Should you buy STC stock today?

STC’s leadership in Saudi Arabia’s telecommunications sector, backed by strong dividend payments and aggressive investment in 5G technology, presents a compelling opportunity for investors. Its regional expansion diversifies revenue streams and strengthens market presence.

Investors should be mindful of competitive dynamics, regulatory changes, and technological disruptions that could impact growth. A balanced approach incorporating diversification and ongoing market evaluation is advisable to capitalize on STC’s potential.

Learn more about leading Saudi stocks

Free resources

Before you start investing in STC stock, you should consider using the educational resources we offer like NAGA Academy or a demo trading account. NAGA Academy has lots of free trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a more informed trader.

Our demo account is a great place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading.

Sources:

- Saudi Telecom Company (STC)

- Saudi Telecom Company (SASE:7010) Stock Valuation - Simply Wall St

- Saudi Telecom Company (7010.SR) Stock Price, News, Quote & History - Yahoo Finance

- Saudi Tel Stock Forecast: 7010 Stock Price Prediction, Long-Term & Short-Term Share Revenue - Walletinvestor